Fixed return of 13% per year.

High-end property on the Costa del Sol, Spain

Operation regulated by the U.S. Securities and Exchange Commission (SEC), under Regulation S (Reg S).

Fixed return of 13% per year.

High-end property on the Costa del Sol, Spain

Operation regulated by the U.S. Securities and Exchange Commission (SEC), under Regulation S (Reg S).

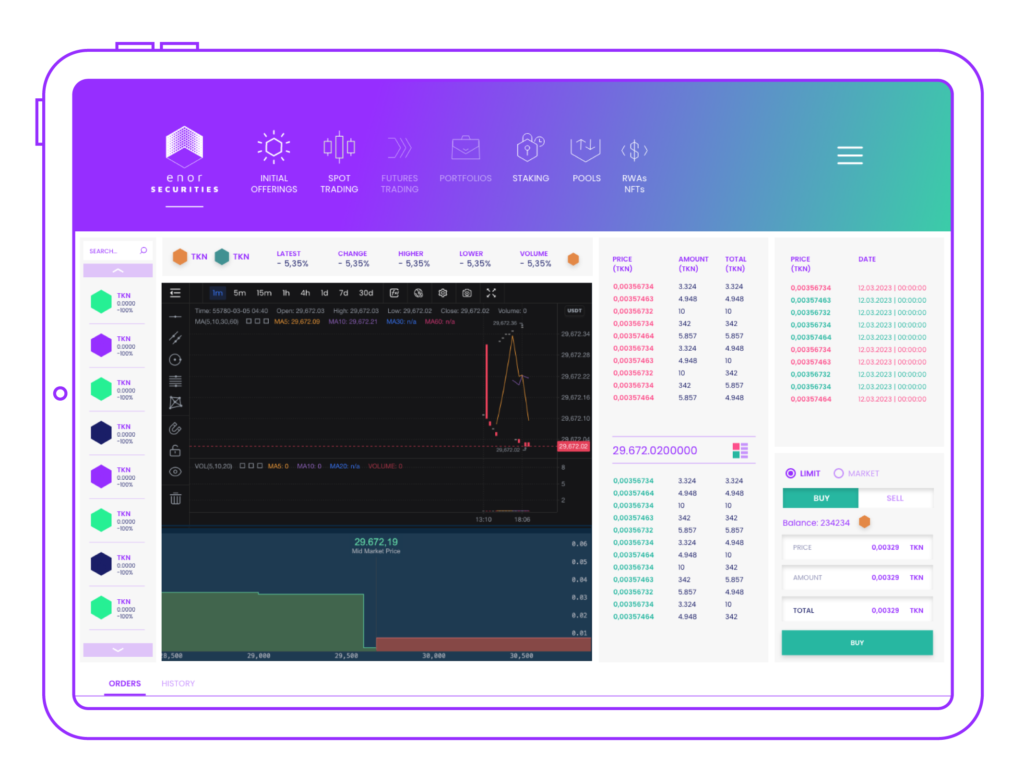

We’ve crafted a versatile platform where you can trade and invest in top-tier security tokens leveraging our deep liquidity and advanced trading technology.

Get exposure to the SOY Market from $5.

Approx. CAGR: 8%

Collateralized by SOY Futures and Custody Contracts.

Profit from a potential second bullish cycle, diversifying investment across different assets.

Get exposure to the COFFEE Market from $5.

Collateralized by COFFEE Futures and Custody Contracts.

Get exposure to the CORN Market from $5.

Collateralized by CORN Futures and Custody Contracts.

Get exposure to the SUGAR Market from $5.

Collateralized by SUGAR Futures and Custody Contracts.

Our platform, fortified by proprietary technology, guarantees the security and reliability of assets that undergo a rigorous validation process led by our expert team.

Our proprietary infrastructure provides a gateway for traders, investors, startups, and institutions, simplifying the world of digital assets.

But we don’t stop there – our expertise extends to advisory, structuring, and the distribution of tokenized real-world assets. We bridge the gap between traditional finance and the blockchain frontier for institutions seeking innovation.

Expert guidance and consulting on the Tokenization of Capital Markets. Assisting clients in the complete process, from structuring and issuance to distribution and addressing legal matters.

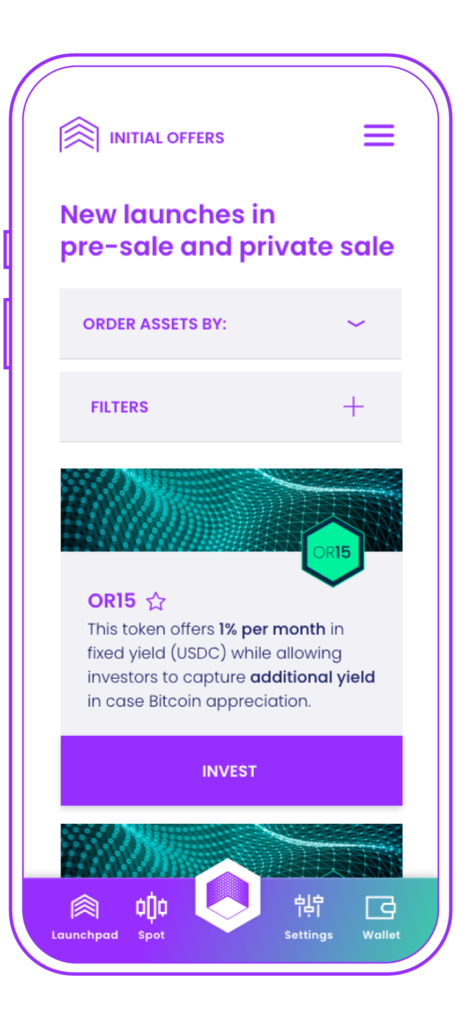

Connecting investors to promising RWA before they hit the market. Find great ideas and highly rated teams that can make them happen.

The most secure way to trade regulated tokenized real world assets. Find low fees, qualified assets and deep liquidity.

We empower businesses of every scale to secure funding and thrive, all within a holistic platform that grants traders seamless access to deep liquidity.

With our tokenization suite, you can expand your reach to investors and tap into new liquidity channels for various assets like Commodities, Stocks, ETFs, Shares, and Real Estate. Maximize value and accelerate your business.

Streamlined and cost-effective token issuance.

Our expert team ensures top-quality tokens on the platform.

Compliant oversight in two regulatory entities.

Robust asset and data protection.

Seize opportunities round the clock.

Near-instant trade settlement for smoother transactions.

Tailor your investments to your unique needs.

Tap into a Global liquidity pool.

Our tailored solutions provide institutional-grade trading platforms, complete with proprietary infrastructure and APIs, ensuring seamless exchange and trading of digital assets. We offer comprehensive services, including staking, OTC services, secure custody solutions, and expert tokenization advisory.

With eNor Securities, institutional clients can harness the full potential of digital assets, backed by robust infrastructure and expert guidance.

We envision a world where equitable wealth distribution and universal access to investment become fundamental rights for all. We aim to transform the way people engage with money, working tirelessly to ensure that finance and crypto merge to harness the best of both worlds for the benefit of all.

Join us on this incredible journey as we redefine what’s possible in the world of finance and technology.

Discover how institutions and investors are taking advantage of RWA tokenization.

Buy and sell smaller portions of high-value assets, making it easier for you to enter and exit positions.

Tokenization of real-world assets allows for fractional ownership, which enhances liquidity.

Expand your investment options beyond your local or regional boundaries.

Save money by removing intermediaries like brokers, banks, and lawyers from the transaction process.

Platforms operate 24/7, there is no need to adhere to traditional market hours.

Invest in a wide range of assets, including real estate, art, precious metals, and more. This diversification can help you spread risk and improve overall portfolio performance

Tokenization encourages distributed ownership, reducing concentration risk and increasing the stability of financial markets.

Tokenized assets are backed by real-world assets.

Access assets that for years have been traditionally reserved for large institutional players.

Assets once considered illiquid, like art or specific real estate properties, can now be easily traded in digital marketplaces. Tokenization of RWA removes entry barriers and allows a wider range of participants in investment opportunities. Verify asset ownership and transactions easily, with blockchain technology all transactions are immutable and transparent.

$ESOY is issued by e-Grains, for detailed information about the token, please refer to e-Grains´ website.

$GREE3 was designed to participate in a potential second bullish cycle in the market, diversifying investment across different second-layer applications, various DeFi protocols, decentralized exchanges, oracles, and companies with low Market Cap and strong fundamentals.